PDF) E-government Adoption Process: XBRL Adoption in HM Revenue and Customs and Companies House | Rania Mousa - Academia.edu

PDF) The Evolution of Electronic Filing Process at the UK's HM Revenue and Customs: The Case of XBRL Adoption | Rania Mousa - Academia.edu

Tax for My Business Administrative Burdens Advisory Board July 2013 Clare Sheehan Business Customer & Strategy

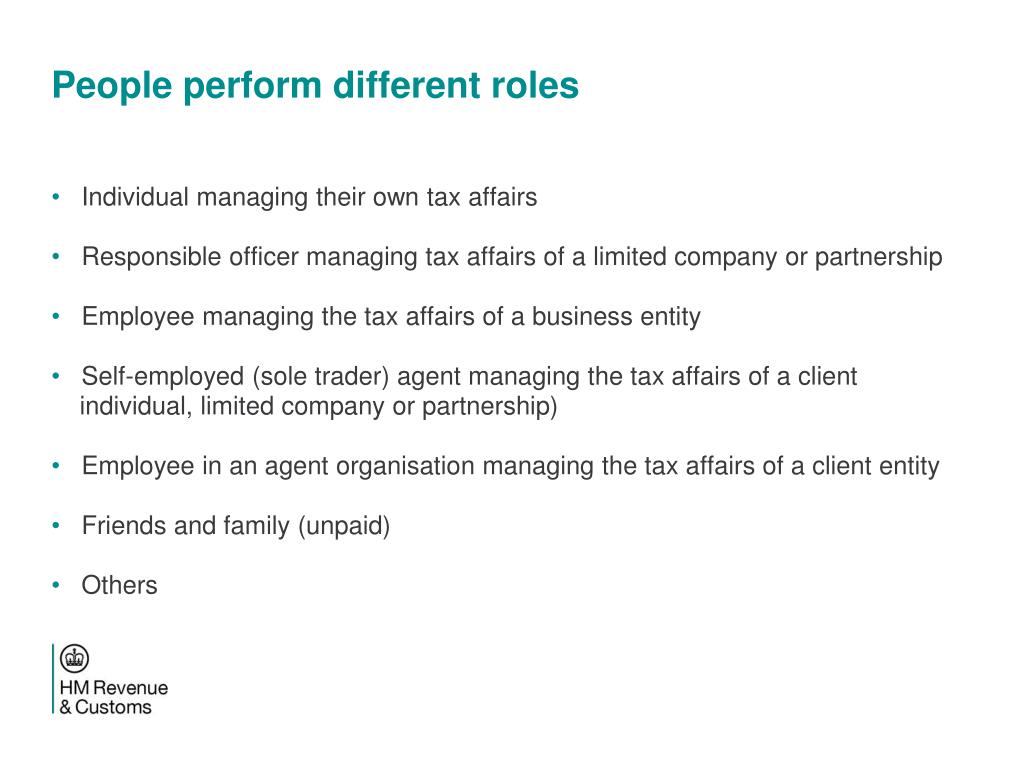

HMRC: Digital by Default The story so far and next steps Julian Hatt – Head of Customer Engagement Carroll Barnett – Agent Account Manager. - ppt download

HMRC: Digital by Default The story so far and next steps Julian Hatt – Head of Customer Engagement Carroll Barnett – Agent Account Manager. - ppt download

HMRC: Digital by Default The story so far and next steps Julian Hatt – Head of Customer Engagement Carroll Barnett – Agent Account Manager. - ppt download

HMRC: Digital by Default The story so far and next steps Julian Hatt – Head of Customer Engagement Carroll Barnett – Agent Account Manager. - ppt download

HMRC: Digital by Default The story so far and next steps Julian Hatt – Head of Customer Engagement Carroll Barnett – Agent Account Manager. - ppt download

HMRC: Digital by Default The story so far and next steps Julian Hatt – Head of Customer Engagement Carroll Barnett – Agent Account Manager. - ppt download

Digital by Default – The Story so far and Next Steps, and AAM Update Julian Hatt, John McRae Head of Customer Understanding and AAM, HMRC. - ppt download

Tax for My Business Administrative Burdens Advisory Board July 2013 Clare Sheehan Business Customer & Strategy

PDF) Seasonal Dependence of Cold Surges and their Interaction with the Madden–Julian Oscillation over Southeast Asia

HMRC: Digital by Default The story so far and next steps Julian Hatt – Head of Customer Engagement Carroll Barnett – Agent Account Manager. - ppt download

Tax for My Business Administrative Burdens Advisory Board July 2013 Clare Sheehan Business Customer & Strategy